A commercial building has a salvage value of PhP 2 million after 50 years. The annual depreciation …

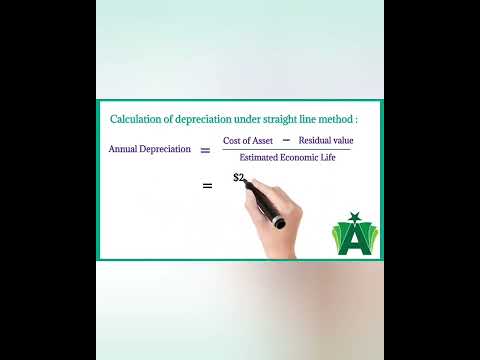

Depreciation |straight line method| #shortsПодробнее

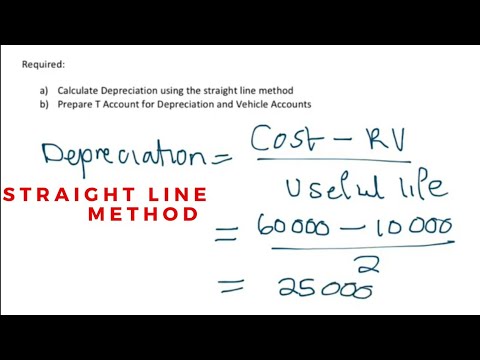

How to calculate Depreciation | Straight Line Method DepreciationПодробнее

Depreciation of a Car ValueПодробнее

What is Depreciation?Подробнее

Find Depreciation of Car after 5 years Word Problem Solution MCR3UПодробнее

How to Find the Book Value after 2 years Using MACRS Depreciation? FE Exam ReviewПодробнее

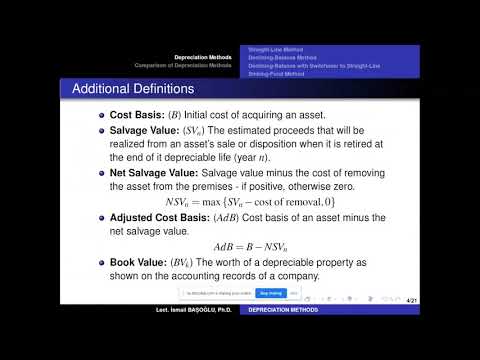

Engineering Economics 41 Depreciation Methods Part IПодробнее

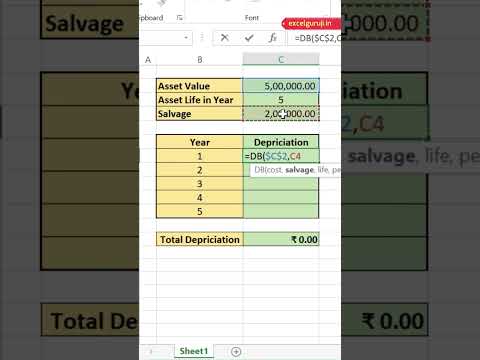

How to Calculate Depreciation Value in Excel #shortsПодробнее

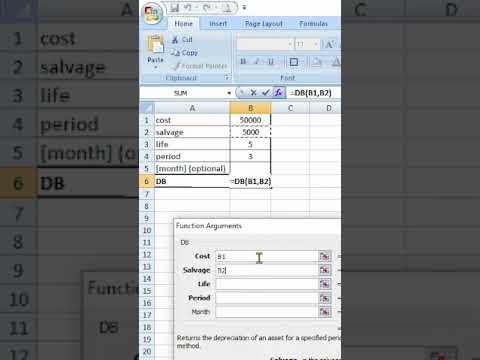

How To Calculate Depreciation By Reducing Balance In Excel | DB Function In ExcelПодробнее

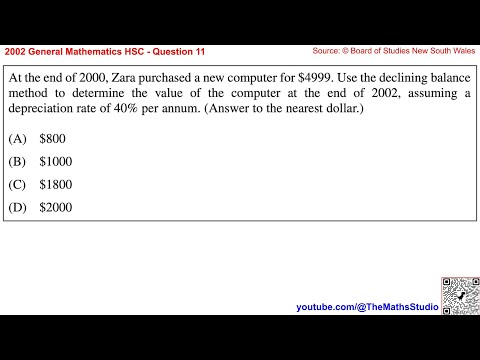

2002 General Maths HSC Q11 Find salvage value of item using declining balance depreciation at 40%p.aПодробнее

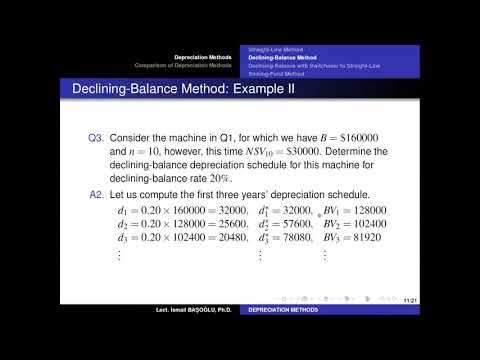

Engineering Economics 42 Depreciation Methods Part IIПодробнее

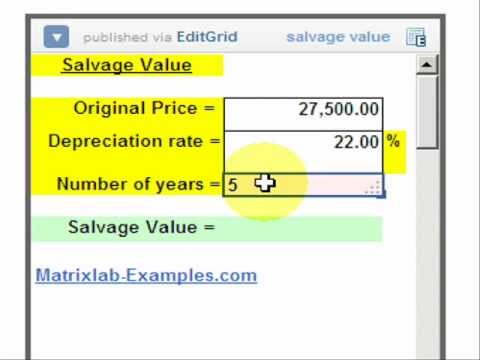

Salvage Value CalculationПодробнее

Real Estate Depreciation ExplainedПодробнее

Salvage Value (Scrap Value) - Meaning, Calculation with Depreciation ExampleПодробнее

Module 8, Video 5 - Selling an Asset at a Gain or Loss - Problem 8-4AПодробнее

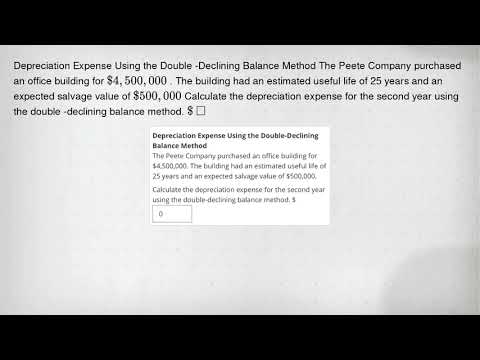

Depreciation Expense Using the Double -Declining Balance Method The Peete Company purchased an officПодробнее

Depreciation and Disposal of Fixed AssetsПодробнее

PMP Exam Prep - Foundations - DepreciationПодробнее

042 - Engineering Economy Chapter 7 DepreciationПодробнее